Southwest Washington Real Estate Market Update – February 2025

The Southwest Washington housing market continues to evolve, with a steady increase in new listings and buyer demand holding strong. Whether you are buying, selling, or investing, keeping an eye on the latest market trends is essential. Here’s a breakdown of the key market data for January 2025 and what it means for you. Southwest Washington Housing Market at a Glance (January 2025 Data) New Listings: 594 (+8.6% YoY) Pending Sales: 500 (+12.4% YoY) Closed Sales: 400 (+29.4% YoY) Median Home Price: $529,000 (+3.6% YoY) Average Home Price: $570,000 (No change YoY) Inventory: 3.1 months Days on Market: 77 These numbers indicate that while inventory is increasing, demand remains strong, keeping home prices stable and slightly rising in certain areas. What This Means for Buyers and Sellers For Sellers: Strong Buyer Interest, But Pricing Is Key With closed sales up 29.4% year-over-year, buyers are still active, and homes are moving. However, with inventory levels increasing to 3.1 months, pricing your home correctly is more important than ever. Homes that are well-priced and well-presented will continue to attract competitive offers. For Buyers: More Inventory, But Competition Remains The increase in new listings (+8.6%) means buyers have more options, but the rise in pending sales (+12.4%) shows that competition is still strong. If you are looking to buy, it’s essential to have pre-approval in place and be ready to act quickly when you find the right home. Neighborhood Trends: Where Are Home Prices Now? Different areas of Southwest Washington are seeing varying trends in home prices. Here are some of the median home prices across key regions: Clark County: $540,000 (+2.9% YoY) Cowlitz County: $415,000 (+3.1% YoY) Camas/Washougal: $670,000 Vancouver (Downtown): $485,000 Ridgefield: $625,200 Battle Ground: $499,900 Brush Prairie/Hockinson: $584,900 With inventory at 3.1 months, understanding local trends is crucial for both buyers and sellers in positioning themselves strategically. Affordability and Mortgage Trends The affordability index for Southwest Washington shows that a household earning the median income of $116,900 can afford 88% of a typical monthly mortgage payment on a median-priced home ($539,200). This assumes a 20% down payment and a 30-year fixed mortgage rate of 6.63%. For buyers looking for ways to enter the market, exploring first-time homebuyer programs, VA loans, and other financing options can make homeownership more accessible. Thinking About Buying or Selling? Let’s Talk Real estate is always evolving, and having an experienced professional on your side makes all the difference. Whether you’re buying your first home, selling a property, or investing, I’m here to help you navigate the market with expert advice and strategy. Contact Nathan Stancil – Your Southwest Washington Real Estate Expert Nathan Stancil Real Broker LLC Call or text: 503.621.4693 Email: nathan@stancilre.com Browse Listings: exploreoregonhomes.com If you have questions about the market, home values, or buying and selling strategies, let’s connect. Portland Market Report

Read More

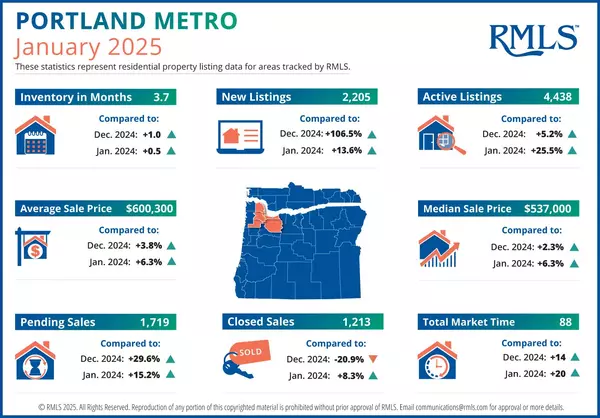

Portland Metro Real Estate Market Update – February 2025

Portland Metro Real Estate Market Update – February 2025 The Portland housing market continues to evolve, and whether you’re thinking about buying, selling, or investing, staying informed is key. As we move into 2025, we’re seeing rising home prices, more listings, and strong buyer demand despite homes spending slightly longer on the market. Here’s a breakdown of the latest real estate trends in Portland Metro and what they mean for you. Portland Metro Housing Market at a Glance (January 2025 Data) New Listings: 2,205 (+13.6% YoY) Pending Sales: 1,719 (+15.2% YoY) Closed Sales: 1,213 (+8.3% YoY) Median Home Price: $537,000 (+6.3% YoY) Average Home Price: $600,300 (+6.3% YoY) Inventory: 3.7 months Days on Market: 88 These numbers tell us that more homes are hitting the market, but demand remains strong, leading to steady price increases across the metro area. What This Means for Buyers and Sellers For Sellers: A Strong Market, But Pricing Matters With home values up by 6.3% year-over-year, sellers have an opportunity to get top dollar for their homes. However, with inventory rising to 3.7 months and homes spending an average of 88 days on the market, pricing competitively is more important than ever. If you’re planning to sell, working with an experienced agent who knows how to position your home in this evolving market can make all the difference. For Buyers: More Options, But Competition Remains Inventory is increasing, giving buyers more choices, but demand remains strong. With pending sales up 15.2%, it’s clear that buyers are still active and ready to move when they find the right home. If you’re planning to buy in 2025, here are some key strategies for success: Get Pre-Approved: With competition still high, having financing in place gives you an edge. Act Quickly: Homes are selling in just under three months, so waiting too long could mean missing out. Work with a Pro: A local real estate expert can help you navigate competitive offers and find hidden opportunities. Neighborhood Trends: Where Are Home Prices Now? The real estate market varies significantly depending on location. Here’s a look at median home prices across different areas of Portland Metro: Lake Oswego/West Linn: $767,500 Beaverton/Aloha: $520,000 Northeast Portland: $480,000 Gresham/Troutdale: $505,000 West Portland: $636,300 Whether you’re looking for a quiet suburban setting, a historic neighborhood, or an urban vibe, understanding these local trends is crucial when buying or selling. Affordability and Mortgage Trends The affordability index for Portland Metro shows that a household earning the median income of $116,900 can afford 89% of a typical monthly mortgage payment on a median-priced home ($535,000). This is based on a 20% down payment and a 30-year fixed mortgage rate of 6.63%. This means affordability is still a challenge for many buyers, but there are strategies to make homeownership more accessible, including exploring first-time homebuyer programs, VA loans, and low down payment options. Thinking About Buying or Selling? Let’s Talk Whether you're considering listing your home, buying your first house, or investing in real estate, having the right strategy matters in this market. I work closely with buyers and sellers across Portland Metro to navigate the changing landscape and make smart, informed moves. Let’s talk about your real estate goals and how I can help you achieve them. Contact Nathan Stancil – Your Portland Real Estate Expert Nathan Stancil Real Broker LLC Call or text: 503.621.4693 Email: nathan@stancilre.com Browse Listings: exploreoregonhomes.com About Us If you have questions about the market, home values, or buying and selling strategies, let’s connect. Southwest Washington Market Report

Read More