The Hidden Costs of Owning a Floating Home (And How to Budget Wisely)

What Makes Floating Homes Unique?

Floating homes are stationary dwellings moored in designated slips, connected to municipal services like water and electricity—unlike houseboats, which can navigate open water. Portland has one of the largest and most established floating home communities in the U.S., with neighborhoods ranging from vibrant Hayden Island to the tranquil Multnomah Channel.

Upfront Costs: More Than Just the Listing Price

Purchase Price

In Portland, floating homes range from under $100,000 (often requiring cash due to float issues) to over $1.5 million for luxury properties. Don't assume floating homes are cheaper alternatives to land homes—they can cost just as much, especially in popular moorages.

Slip Ownership vs. Rental

A critical cost distinction is whether the moorage slip is owned (typically with HOA fees) or rented (with monthly rent). Owned slips offer long-term security and equity, while rented slips may leave you exposed to rising costs.

-

Owned Slip HOA Fees: $195–$500/month (average ~$350)

-

Rented Slip Fees: $600–$1,100+/month

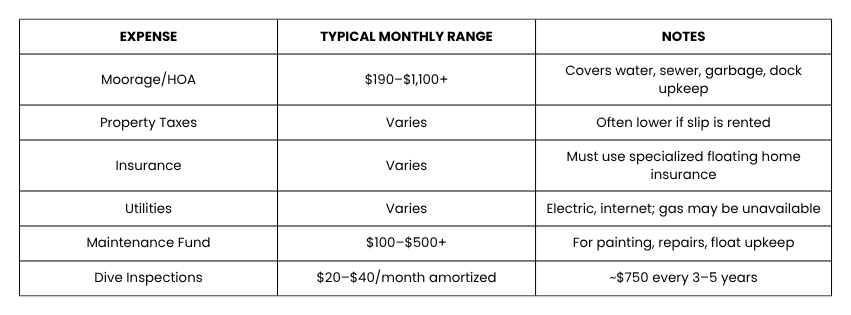

Monthly & Ongoing Expenses

Budgeting for a floating home requires a broad view of recurring expenses, which differ significantly from traditional homes.

Financing Challenges: Expect to Pay 20% Down

Most floating home loans in Oregon require 20% down, and only a handful of lenders—such as Trailhead Credit Union and Banner Bank—offer them. FHA and VA loans aren’t applicable. If you're shopping for homes under $150,000 or with float issues, be prepared to pay cash.

Insurance: Specialized and Sometimes Costly

Standard homeowner policies don’t cover floating homes. You’ll need a policy tailored to marine living, which may come with exclusions (e.g., sinking may not be covered unless caused by a named peril) and possibly higher premiums.

Recommended local insurers:

-

Hokanson Insurance Agency (Portland)

-

Anchor Marine Underwriters

Maintenance: Not Optional

Between river exposure and the structure’s unique foundation, maintenance costs can quickly add up. Regular exterior upkeep, float inspections, and weatherproofing are essential for long-term value.

Typical Annual Maintenance Budget: $1,200–$6,000+

-

Repainting, sealing, or repairs: $500–$2,500 every 2–4 years

-

Dock maintenance and system servicing: $700–$3,000 annually

-

Dive inspections: ~$750 every 3–5 years

Regulatory & Community Considerations

Living on the water means navigating a complex landscape of city rules and moorage regulations. Portland City Code Titles 19 and 28 lay out specific safety, plumbing, and spacing requirements. Moorage communities may also have strict rules on:

-

Pet ownership

-

Smoking

-

Rentals (short-term typically banned)

-

Noise levels

-

Dock safety

Before purchasing, review all HOA or moorage bylaws in detail to ensure compatibility with your lifestyle.

Real Portland Stories: Floating Dreams in Action

Meet Sarah, a Portland graphic designer who starts each day with coffee on her floating deck, watching kayakers drift by. Or David and Susan, retirees who downsized to a floating home on the Multnomah Channel to embrace a quieter, nature-focused life. These stories are common among Portland’s floating home community—lifestyle-first decisions backed by realistic financial planning.

Final Thought: Is It Worth It?

For those drawn to river life and prepared for the financial realities, floating homes can be a rewarding investment. However, this is not a lifestyle for the unprepared. Thorough budgeting, diligent inspections, and a strong financial foundation are your best tools to avoid surprises and fully enjoy the "permastaycation" lifestyle.

Ready for a deeper dive into Understanding River life on a floating home? The full guide is available here.

Categories

- All Blogs (25)

- Buyer & Seller Tips (2)

- Buyer Tips (4)

- Environmental Hazards (1)

- Floating Homes (4)

- Green Homes (1)

- Home Buying (2)

- Home Improvement & Remodeling (1)

- Home Improvement ROI (2)

- Home Preparation (2)

- Home Selling (8)

- Home Selling Tips (2)

- House Improvement (1)

- Inspection (1)

- Market Strategies (1)

- Market Trends (1)

- Market Updates (2)

- Portland (10)

- Portland Market Advice (1)

- Portland Market Insights (1)

- Portland Real Estate (3)

- Portland Real Estate Market (1)

- Real Estate Advice (1)

- Real Estate Investment Tips (1)

- Real Estate Tips (13)

- Seller Advice (1)

- Seller Preparation (1)

- Sustainability in Housing (1)

- Vancouver Real Estate (1)

Recent Posts